In this article, we summarize what we believe to be the three most important points to take into account when it comes to the banking market, and what you as an advertiser should think about. Lots of useful info, in just a few minutes!

The Norwegian economy is doing well, but the population is increasingly worried about price increases for a number of goods and services.

Norwegians' expectations of their own finances are falling sharply. After many years of low interest rates, we now see a downward trend in optimism regarding the future and the household's financial situation. The sharp increase in the price of electricity that parts of the country experienced last autumn and winter, followed by high price increases in fuel, food and goods and services we depend on in our everyday lives, gives the population worries and makes us more pessimistic about the economic outlook in the coming year.

Norwegians' expectations of their own finances are falling sharply. After many years of low interest rates, we now see a downward trend in optimism regarding the future and the household's financial situation. The sharp increase in the price of electricity that parts of the country experienced last autumn and winter, followed by high price increases in fuel, food and goods and services we depend on in our everyday lives, gives the population worries and makes us more pessimistic about the economic outlook in the coming year.

Few people change banks, but when we do, it is to get better conditions.

The proportion who switch banks is still low, and has remained stable year after year. The most important reasons for changing banks or acquiring an additional bank are to obtain better conditions, either in the form of a lower interest rate on the mortgage, a higher interest rate on savings or lower fees. With a number of announced interest rate increases throughout the autumn, it will be exciting to see whether we choose to stick with our main bank, or whether we will change banks to a greater extent than before in order to secure the best conditions. The results from this year's survey show that half of the population feels that the terms of the mortgage are competitive, but there is a significant decrease compared to last year.

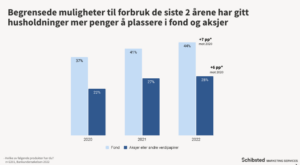

Limited opportunities for consumption in the last 2 years have given more room for the purchase of funds, shares and securities.

The pandemic has had a major impact on consumption in the population over the past 2 years. Less money spent on travel and experiences has meant that more people have chosen new forms of savings. We still save to the greatest extent in the bank, but last year we saw an increase in the proportion who acquired shares and securities, and this year's results show an increase in the proportion who have acquired funds. As last year, the growth is greatest among people under 40 years of age.

The pandemic has had a major impact on consumption in the population over the past 2 years. Less money spent on travel and experiences has meant that more people have chosen new forms of savings. We still save to the greatest extent in the bank, but last year we saw an increase in the proportion who acquired shares and securities, and this year's results show an increase in the proportion who have acquired funds. As last year, the growth is greatest among people under 40 years of age.

The last 12 years have FINN personal finance carried out a survey where the main aim is to map the most important drivers and trends in the banking market. This year's survey was carried out in May and the results from this year's bank survey were presented at a customer seminar in mid-June.

If you would like a review of the results from this year's survey, you can contact Erik Kristiansen in FINN personal finances (erik.kristiansen@schibsted.com)