Every year, we conduct the car survey in collaboration with FINN. The purpose of the survey has been to map the buying behavior, priorities and attitudes of Schibsted's readers who are interested in cars. Below you will find the 5 most important findings from this year's car survey.

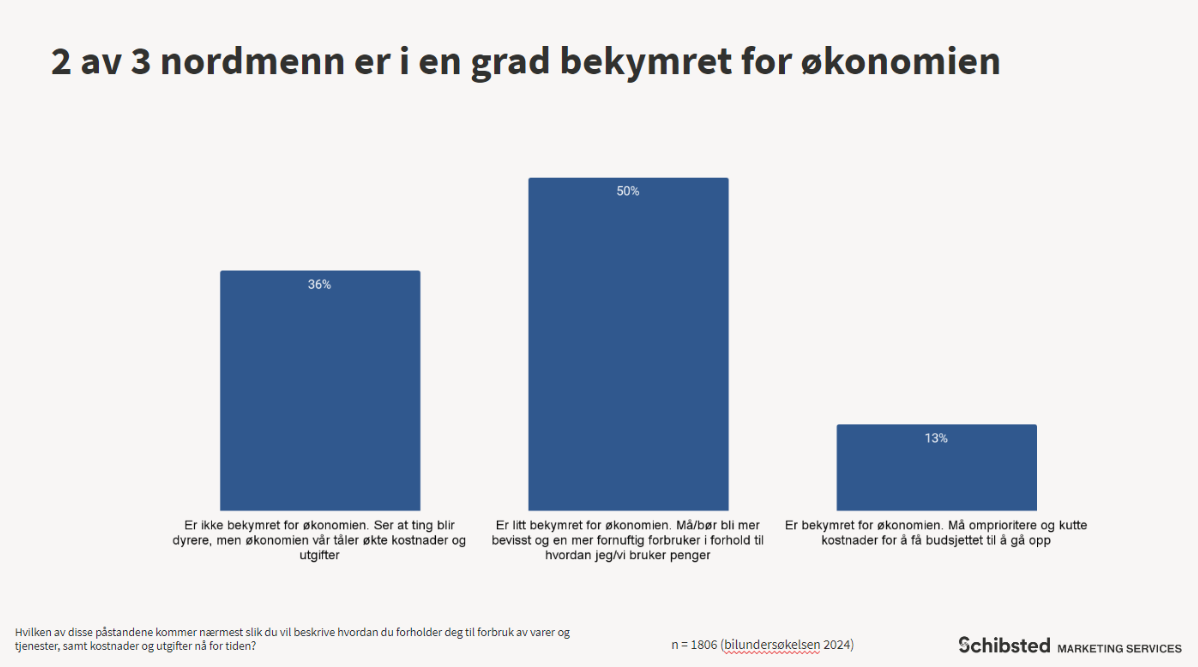

1. Concern about the economy is evident, but it varies across the population.

Figures from Schibsted's population survey and figures from the car survey show that many Norwegians are worried about the economy. We see that two out of three (63%) are to some extent worried about the economy and among these, 13% say that they have to reprioritize and cut costs to make their budget go up.

The oldest and youngest in the population are the least concerned, and those in the 30-50 age group with children living at home and high levels of borrowing are the most concerned

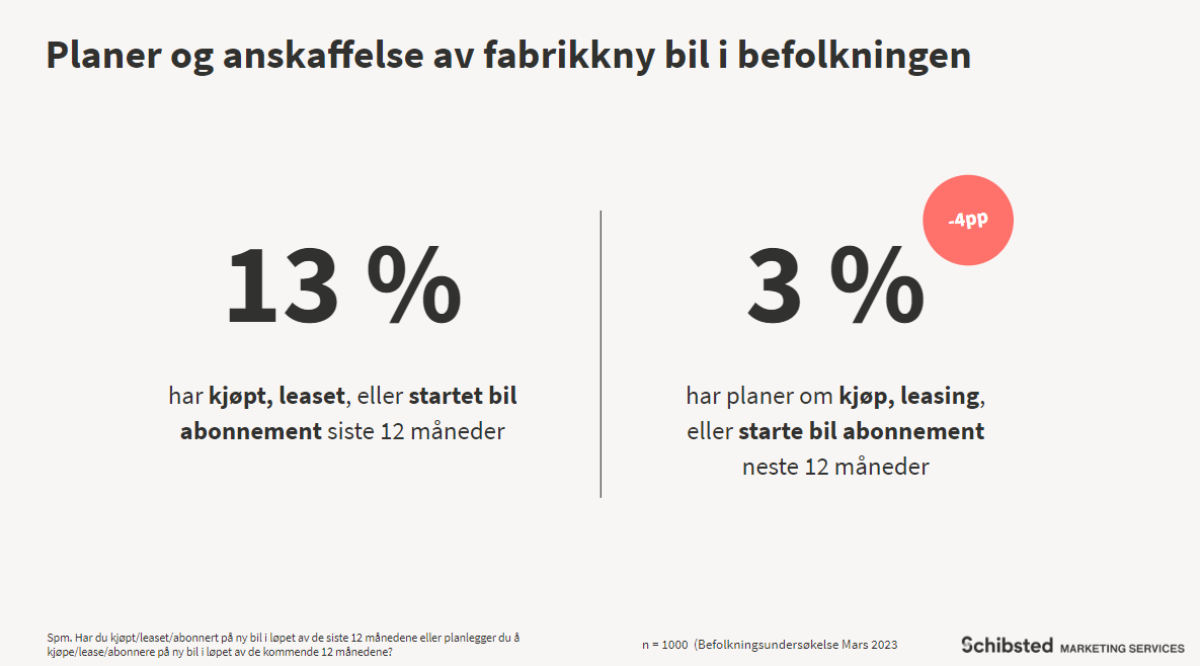

2. Plans to buy a new car have fallen sharply since the last survey

In the car survey, where the sample is specifically interested in cars, there is little change in the number of people who have already bought a car or those who are planning to buy a car. Among the entire population, on the other hand, we see that those who plan to buy a new car drop sharply. We also see the same when it comes to used cars.

The economy in general, as well as new rules such as VAT and weight limits for electric cars, and stricter rules on maximum loan limits for households, are clearly affecting Norwegians' plans to buy a car.

3. Uncertainty in technological development has affected new car buyers to a greater extent than last year

Although there have been many political changes in connection with, in particular, the purchase of electric cars (VAT, weight limit), it is uncertainty in technological development that has had the greatest impact among new car buyers.

Our hypothesis is that buyers of new cars see new and "better" cars, especially electric cars, with better battery capacity and mileage at relatively short intervals. A hypothesis that is also supported by what respondents emphasize when choosing a car.

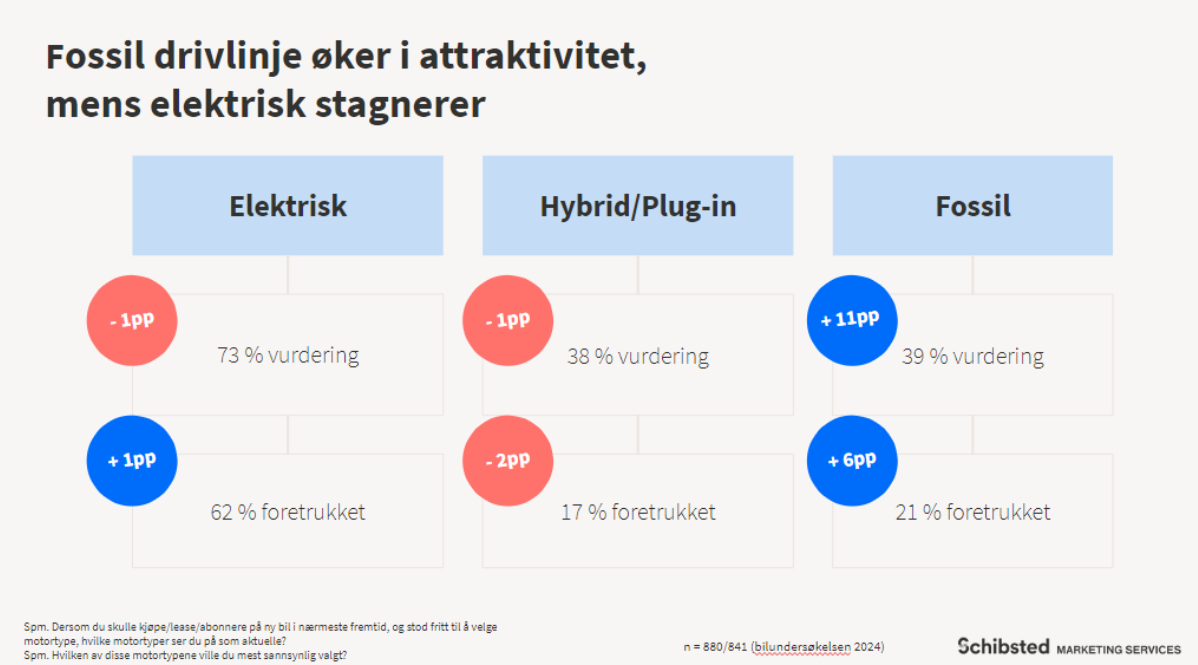

4. Significant increase in the proportion considering and preferring fossil fuel powertrains for the first time in several years

Electric powertrain is of course the powertrain that is still the most considered and preferred, but we see that this remains stable compared to last year. Where we see a significant increase is in the proportion considering and preferring fossil fuel powertrains for the first time in many years.

This is most likely related to the fact that the differences in the benefits between fossil and electric are becoming more and more blurred, and when the incentives to buy electric are reduced, more people will both consider and prefer fossil powertrains.

5. Brand associations are changing

Tesla has long been strong in many of the brand associations, but since the 2021 car survey, we have seen them gradually lose positions to various brands. One of these brands is Fisker, which this year, despite barely having cars on Norwegian roads, climbs to the top in two of two important brand associations; Innovative and Environmentally friendly.

That said, it doesn't seem to have affected Tesla's sales much as they, with their Model Y, have ~21% market share in Norway.